The Risks and Rewards of Trading Crypto with Leverage

Crypto markets in 2025 are a wild ride, with 5-10% daily swings fueled by US-China tariffs and inflation fears. Crypto leverage trading amplifies these moves, letting traders boost returns with borrowed funds. A 10x leverage turns a $1,000 investment into $10,000 of market exposure. But this power comes with peril - losses magnify too. As the crypto trading market grows, with $50 billion in copy trading assets in 2024, leverage is a hot strategy. This article explores its rewards and risks for smarter trading.

Rewards of Crypto Leverage Trading

Leverage magnifies profits. A 2% BTC price jump from $110,591 to $112,803 with 10x leverage yields 20% returns on your capital, turning $1,000 into $1,200. Top traders hit 12-20% annual gains in 2024 using leverage smartly.

It’s accessible. You can start with $100, controlling larger positions. This opens crypto futures to retail traders, unlike traditional markets needing bigger capital. Leverage thrives in volatile assets like ETH at $4,005.

Diversification is easier. Leverage lets you trade multiple assets - BTC, ETH, or altcoins - with small funds, spreading risk. It’s a high-octane path to outsized gains.

Risks of Using Leverage in Crypto

Leverage amplifies losses. A 10% BTC drop at 10x leverage wipes out your $1,000 stake entirely - 80% of retail traders lose money due to this. October’s 12% crash showed this risk.

Liquidations are brutal. If prices hit your margin call, like $108,000 for a BTC long, positions close automatically, locking in losses. Volatility fuels this - $178 million in crypto longs liquidated in early October.

Fees add up. Spreads and funding rates of 0.1-0.5% per trade erode profits. Over-reliance on high leverage without skill risks ruin, especially in choppy markets.

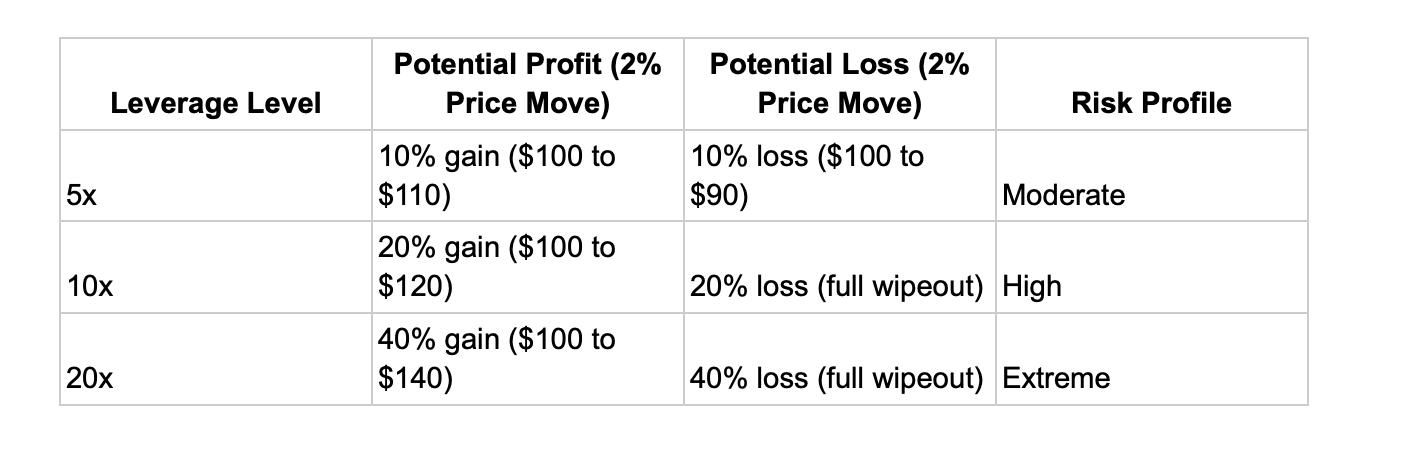

Crypto Risk Chart

Strategies to Balance Risks and Rewards

Choose leverage wisely. Stick to 5x or less for beginners to limit wipeouts - a 2% drop at 5x loses 10%, not 100%. Pros use 10x for calculated bets, like shorting ETH at $4,200 resistance.

Manage risks tightly. Set stop-losses at 5-10% below entry, cap capital at 1-2% per trade. Use demo accounts to test leverage strategies. Monitor funding rates to avoid fee traps.

Copy trading helps. Mirroring pros’ leveraged trades, like a BTC long at $110,591 support, leverages their timing. Pick traders with 80%+ win rates and low drawdowns under 10% to balance risk.

Conclusion

Crypto leverage trading offers high rewards but steep risks. A 2% price move can yield 20% gains with 10x leverage, but 80% of traders lose due to volatility and liquidations. Start with low leverage, set tight stops, and cap risk at 1-2%. Copy trading can align you with pros’ strategies, boosting your edge. In 2025’s wild markets, leverage is a powerful tool - use it with discipline to turn volatility into opportunity.